Introduction

On 3rd September 2025, the 56th GST Council Meeting chaired by Finance Minister Nirmala Sitharaman announced some of the most significant tax reforms since GST was rolled out in 2017. With a sharp focus on the common man, aspirational middle class, and MSMEs, the Council simplified tax rates, reduced costs on essential goods, and strengthened trade facilitation.

At FinAathma, we see this as more than just tax changes—it’s a moment of transition where individuals and businesses will need clear guidance to adapt, plan, and optimize.

Key Announcements You Should Know

1. GST Rate Rationalisation

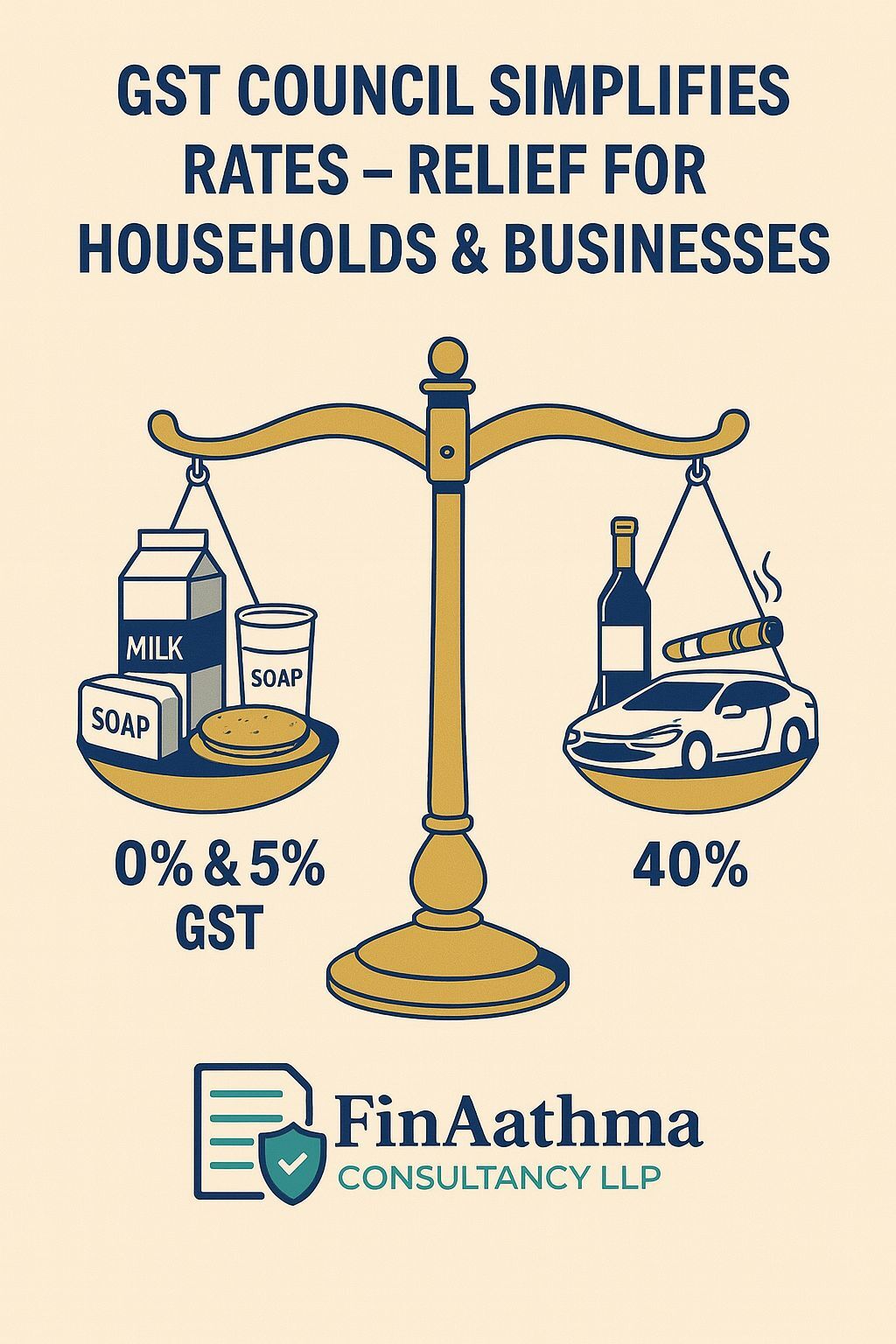

- Essentials like milk (UHT), paneer, breads, chapati, paratha moved to 0% GST.

- Household staples like ghee, butter, cheese, hair oil, toothpaste, shampoos, soaps dropped to 5% GST.- Luxury and “sin goods” (tobacco, pan masala, high-end cars, yachts) face 40% levy.- Mid-range items like TVs, ACs, dishwashers, small cars, auto parts reduced from 28% to 18%.2. Phased Implementation (Effective 22nd September 2025)- Most goods and services will see revised rates from 22nd September 2025.

What This Means for You- Tobacco-related products will retain higher cess until compensation cess obligations are cleared.3. Trade Facilitation & Refunds- Provisional refunds up to 90% for inverted duty structure claims—system driven, risk-based.- Automated refund timelines for exporters to bring faster liquidity.4. Institutional Strengthening – GSTAT- The long-awaited GST Appellate Tribunal (GSTAT) to become operational by September-end 2025 and hear cases from December.- This ensures faster dispute resolution and consistency in rulings.- Consumers: Lower costs on essentials = more savings in your pocket.

- Businesses: Compliance simplification, lower working capital blockage, and clarity on disputes.

- Exporters & MSMEs: Faster refunds and quicker registration processes.

How FinAathma Adds Value in This Transition

Navigating these changes requires more than reading a notification. That’s where we step in:

📊 Rate Mapping & Transition Planning – We’ll map your current product/services to new GST rates and update accounting systems accordingly.

🔎 Compliance & Refund Advisory – Helping you claim provisional refunds, ITC reconciliation, and ensuring no refund is stuck due to system mismatches.

⚖️ Litigation Support – With GSTAT coming in, our team will prepare you for appeals and advance rulings.

💡 Strategic Advisory – Beyond compliance, we help businesses leverage GST savings into growth strategies.

At FinAathma Consultancy LLP, we don’t just “file GST returns”—we build clarity, confidence, and systems.

Human Takeaway

For a family buying groceries, for a student paying for essentials, or for an entrepreneur planning scale-up—these rate cuts are a relief. Yet, for businesses, the real challenge is transition management.Change is opportunity. With the right partner, this GST reset can translate into profitability, ease of compliance, and financial peace of mind.Call-to-Action

👉 Confused about how these GST changes apply to you?