Tax Regime Showdown FY 2025–26: Which One Actually Saves You More?

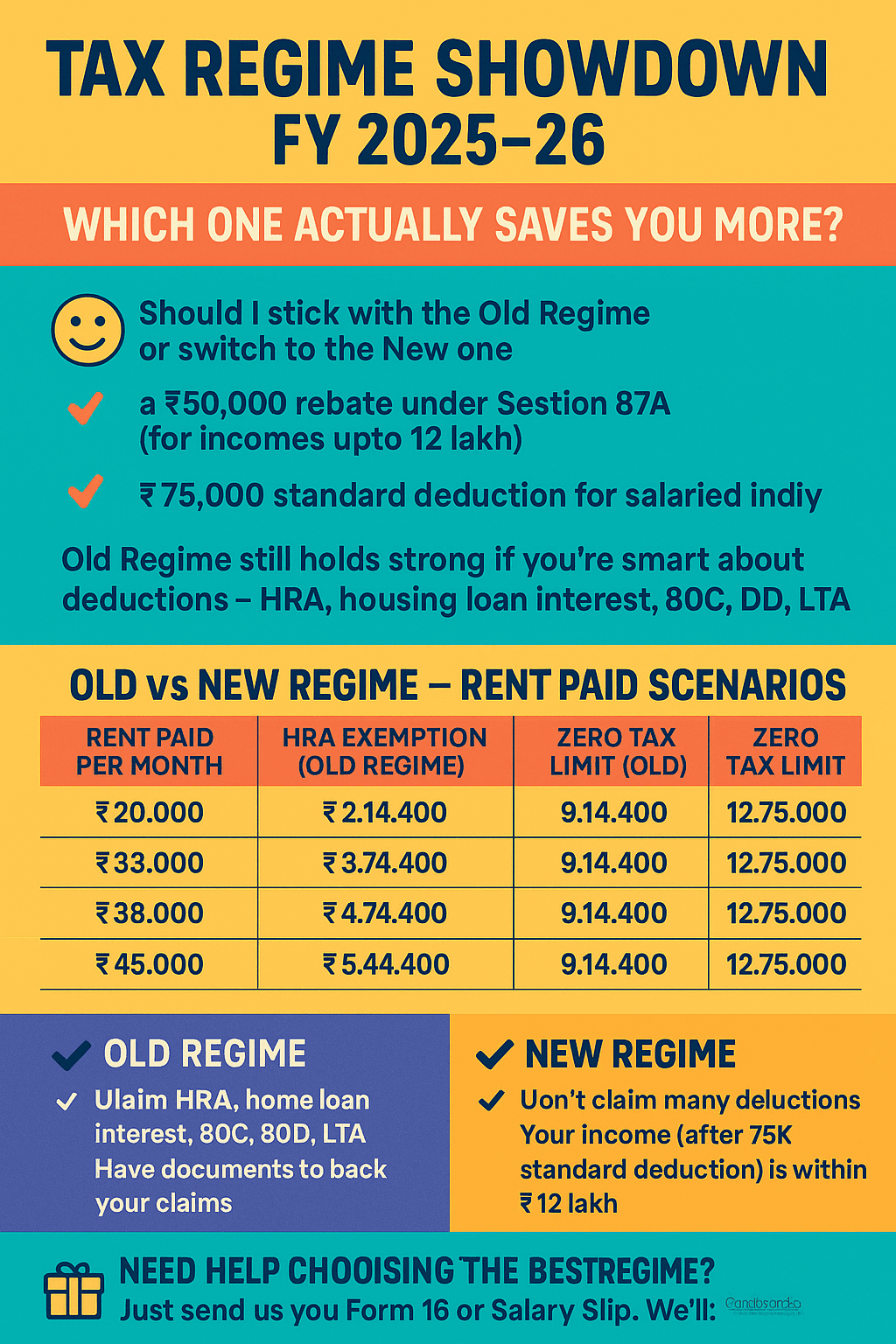

With the new income tax rules for FY 2025–26 kicking in, one big question is back on everyone’s mind — Should I stick with the Old Regime or switch to the New one?

Here’s the good news:

The New Regime just got more attractive with two key benefits:

- A ₹60,000 rebate under Section 87A (for incomes up to ₹12 lakh)

- A higher ₹75,000 standard deduction for salaried individuals

But hold on — the Old Regime still holds strong if you’re smart about claiming deductions. Think HRA, home loan interest, 80C, 80D, and LTA. If you’ve got them all, the Old Regime might still be your best friend.

Can You Claim Both HRA and Home Loan Interest?

Yes — but only under certain conditions:

You must:

1. Actually live in a rented house

2. Own another house that is self-occupied or rented out

3. Be able to show proof: rent receipts, lease agreements, and interest certificates

Important: Most employers won’t allow both HRA and housing loan exemptions unless all documents are in place.

| Rent Paid (Monthly) | Annual Rent Paid | Approx. HRA Exemption |

| ₹ 20,000 | ₹ 2,40,000 | ₹ 1,70,000 |

| ₹ 25,000 | ₹ 3,00,000 | ₹ 2,30,000 |

| ₹ 30,000 | ₹ 3,60,000 | ₹ 2,90,000 |

| ₹ 35,000 | ₹ 4,20,000 | ₹ 3,50,000 |

| ₹ 40,000 | ₹ 4,80,000 | ₹ 4,10,000 |

| ₹ 45,000 | ₹ 5,40,000 | ₹ 4,70,000 |

| ₹ 50,000 | ₹ 6,00,000 | ₹ 5,30,000 |

Old vs New Regime — A Real-World Comparison

Scenario | Deductions (Old Regime) | Zero Tax Limit (Old) | Zero Tax Limit (New) |

HRA + Housing Loan Claimed | ₹6,74,400 | ₹11,74,400 | ₹12,75,000 |

Only HRA Claimed | ₹4,74,400 | ₹9,74,400 | ₹12,75,000 |

Only Housing Loan Claimed | ₹4,74,400 | ₹9,74,400 | ₹12,75,000 |

So, Which Regime Is Right for You?

✅ Go with the Old Regime if: i) You’re claiming HRA, home loan interest, 80C, 80D, LTA, etc.ii) You have the necessary proofs to back it up

✅ Opt for the New Regime if: i) You aren’t claiming many deductions

ii) Your income after standard deduction is within ₹12 lakh

💼 Need Help Deciding?

Send us your Form 16 or Salary Slip, and we’ll:i) Compare tax under both regimes

ii) Guide you on the best deductions to claim

iii) File your ITR correctly and early